Let's add style to our current liabilities, contingencies, and long term liabilities!

Let's begin!

Let's begin!

Our current topic:

Chapter 13 -

Current Liabilities and contingencies

My textbook and Gleim which I will be using as a source of reference:

FASB, defines liabilties as: Probable Future Sacrifices of Economic Benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events.

Accounts Payable (trade accounts payable) - Balances owed to others for shopping too much for items such as goods, supplies, or services purchased on open account.

You can think of it like a credit card. This account results when we owe our vendors. There is a time frame between when we purchase the item on credit and the payment for it - which in this case, results at the end of the month when our credit card company sends us the bill and we send payment.

In other business situations, the terms of the sale (e.g., 2/10, n/30) state the period of extended credit. For example - You will get a 2% discount for repaying your debt in 10 days, or the net payment is due in full in 30 days. When companies are offered repayment deals such as these - it is smart to take advantage.

So what's a current liability?

Obligations whose liquidation is reasonably expected to require use of existing resources properly classified as current assets, or the creation if other current liabilities.

Typical Current Liabilties:

-

Accounts payable.

-

Notes payable.

-

Current maturities of long term debt.

-

Short-term obligations expected to be refinanced.

- Dividends payable.

- Customer advances and deposits.

- Unearned expenses.

- Sales taxes payable.

- Income taxes payable.

- Employee-related liabilities.

Notes payable - Written promises to pay a certain sum of money on a specific future date.

-

Arise from purchases, financing, or other transactions.

-

Notes classfied as short-term (within year) or long-term (beyond year)

-

Notes may be interest-bearing or zero-interest-bearing.

Let's look at an illustration on Interest-bearing notes!

(Interest-Bearing-Note)

On March 1, 2011, Victorias secret agrees to lend $100,000 to Annie Gardner Co. if she signs a $100,000, 6 percent, four-month note. Annie Gardner Co. records the cash received on March 1 as follows:

Cash 100,000

Notes Payable 100,000

(record at present value of future cash flow)

If Annie Gardner Co. prepares financial statements semiannually, it makes the following adjusting entry to recognize interest expense and interest payable at June 30:

Interest calculation = ($100,000 x 6% x 4/12) = $2,000

(4/12: remember it was a four month note, so you divide that by 12 months)

Interest Expense 2,000

Interest Payable 2,000

At maturity (July 1), Annie Gardner Co. records payment of the note and accrued interest as follows:

Notes Payable 100,000

Interest Payable 2,000

Cash 102,000

(These entries are to close the open notes payable and interest payable accounts and to send Victorias secret final payment in full for the note.)

Now let's look at an illustration on Zero-interest-bearing notes....

(Zero-Interest-Bearing-Note)

On March 1, Annie Gardner Co. issues (borrows) a $102,000, four month, zero-interest-bearing note to First Tennessee Bank. The present value of the note is $100,000. Annie Gardner Co. records this transaction as follows:

Cash 100,000

Discount on notes payable 2,000

Notes Payable 102,000*

*This is the amount she will pay First Tenn. back at the maturity date

**The reason Annie has a $2,000 discount on notes payable account is because she hasn't used the money, so she cannot record it as usual interest expense. So - zero interest bearing notes do have interest, it is just hidden in the amount borrowed. This is why the contra liability discount on notes payable account is used. Because it is "zero-interest-bearing."

The discount on Notes Payable account is a contra account to Notes Payable.

Over the life of the note Annie borrowed, she will charge the discount on notes payable to interest expense. Why? Because she's had use of the money.

This entry would be as follows:

Interest Expense 2,000

Discount on notes payable 2,000

**A quick review of the Gross and Net Method from chapter 8 can be found in the Picture Gallery Tab

Let's try another exercise similar to what we have already learned!

The following are selected 2011 transactions of Elle Fashion Corporation.

Sept. 1 Purchased inventory from Dolce & Gabanna Company on account for $50,000. Elle Fashion Corp. records purchases gross and uses a periodic inventory system.

Oct. 1 Issued a $50,000, 12-month, 8% note to Dolce & Gabanna Company in payment of account.

Oct. 1 Borrowed $75,000 from First Tennessee Bank by signing a 12-month, zero-interest-bearing $81,000 note.

Instructions:

a) Prepare journal entries for the selected transactions above.

b) Prepare adjusting entries at December 31.

c) Compute the total net liability to be reported on the December 31 Balance sheet for:

-

the interest-bearing note.

-

the zero-interest-bearing note.

a) Journal entries:

Sept 1. Purchases 50,000

Accounts payable 50,000

Oct. 1. Accounts payable 50,000

Notes payable 50,000

Oct. 1. Cash 75,000

Disc. on notes payable 6,000*

Notes payable 81,000

*This represents 1 year of interest.

b) Adjusting entries: (remember, adjusting entries involve 1 balance sheet account, and 1 income statement account)

For the interest-bearing-note:

We have had use of the money for 3 months (Oct.1-Dec.31) - so we need to generate interest expense for it.

($50,000 x 8% x 3/12) = $1,000

Dec. 31 Interest expense 1,000

Interest payable 1,000

For the zero-interest-bearing note:

$6,000 x 3/12 = $1,500 - Interest expense (remember, we are trying to drive the 6,000 discount to zero over the life of the note.)

Dec. 31 Interest expense 1,500

Discount on notes payable 1,500

c) Compute total net liability to be reported on the Dec. 31 B/S:

1) For the interest-bearing-note -

Notes payable 50,000

Interest payable 1,000

Total net liability = $51,000

2) For the zero-interest-bearing note -

Notes payable 81,000

Less: Disc. on notes payable 4,500

Total net liability $76,500

*A Financial Calculator is provided below - or you can use the Tables located in the PV/FV Tables Tab. Remember, You can't use a Financial Calculator on the CPA exam - So it is best to learn to use the tables now!*

Now that you've got the hang of accounting for interest-bearing and zero-interest-bearing notes, Let's look at a few rules!

Current Maturies of Long-Term Debt

It is possible that a "long-term" obligation maturing currently may be classified as current IF they are to be:

1.) Retired by assets accumulated that have not been shown as current assets.

example - bonds payable, bond sinking fund.

2.) Refinanced, or retired from the proceeds of a new debt issue, or-

(issue more bonds- use proceeds to pay debt. Basically like swapping liabilities.)

3.) Converted into capital stock.

Short-Term Obligations Expected to Be Refinanced:

It is possible that a "current" obligation may be classified as long-term IF the following conditions are met:

1.) Must intend to refinance the obligation on a long-term basis.

2.) Must demonstrate an ability to refinance:

-

Actual refinancing

-

Enter into a financing agreement - (noncancellable agreement)

Now let's try an exercise on Refinancing Short-Term Debt!

On December 31, 2010, Victorias secret had $1,200,000 of short-term debt in the form of notes payable due February 2, 2011. On January 21, 2011, the company issued 25,000 shares of it's common stock for $36 per share, receiving $900,000 proceeds from the stock sale, supplemented by an additional $300,000 cash, are used to liquidate the $1,200,000 debt. The December 31, 2010, balance sheet is issued on February 23, 2011.

Instructions: Show how the $1,200,000 of short-term debt should be presented on the December 31, 2010, balance sheet, include note disclosure.

The short-term debt should be present on the balance sheet as:

A current liability:

Notes payable (note 1) $300,000

Long-term liability:

Notes payable from refinancing (note 1) $900,000

*Footnote- note 1: saying reference to...*

Let's try one more!

On December 31, 2010, Natural Health Spa has $7,000,000 of short-term debt in the form of notes payable to First Tennessee Bank due in 2011. On January 28, 2011, Natural Health Spa enters into a refinancing agreement with First Tennessee Bank that will permit it to borrow up to 60% of the gross amount of its accounts receivable. Receivables are expected to range between a low of $5,000,000 in May to a high of $8,000,000 in October during the year 2011. The interest cost of the maturing short-term debt is 15%, and new agreement calls for a fluctuating interest rate at 1% above the prime rate on notes due in 2015. Natural Health Spa's December 31, 2010, balance sheet is issued on February 15, 2011.

Instructions: Prepare a partial balance sheet for Natural Health Spa at December 31, 2010, showing how its $7,000,000 of short-term debt should be presented, including footnote disclosure.

Current Liability:

Notes payable $4,000,000**

Long-term Liability:

Notes payable from refinancing $3,000,000*

*($5,000,000 x 60%) = 3,000,000

**[$7,000,000 – ($5,000,000 X 60%)]

Because we must be conservative and classify the lower amount.

A few more definitions you should learn:

Dividends Payable - Amount owed by a corporation to its stockholders as a result of board of directors' authorization.

-

Generally paid within three months

-

Undeclared dividends on cumulative preferred stock not recognized as a liability. (Because nothing says that they have to pay)

-

Dividends payable in form of shares of stock are not recognized as a liability. Reported in equity.*becomes a liability on the date of declaration.

-

May be classified as current or long-term.

Example: When you give comcast a $100 deposit - this is not revenue for them, It's a liability.

Unearned Revenues - a payment is received before delivering goods or rendering services.

Example: Purchasing plane tickets online. There is a time frame between payment and the provided service.

So now that you know everything, Let's try an exercise!

Vogue Magazine sold 12,000 annual subscriptions on August 1, 2011, for $18 each. Prepare Vogue's August 1, 2011, journal entry and the December 31, 2011, annual adjusting entry.

August 1. Cash 216,000

Unearned revenue* 216,000

(12,000 x $18) = $216,000

*We have received $216,000 in cash - We use the Unearned revenue account because we haven't provided the services/magazines yet.

Dec. 31 Unearned revenue 90,000

Subscription revenue 90,000

($216,000 x 5/12 = $90,000) [Notice 5 months have passed from August 1 - Dec. 31]

Great! Now you know how Vogue accounts for their subscription revenue!

Next - Let's learn how retailers like Forever 21 account for the sales tax their customers pay!

Sales Taxes Payable - Retailers must collect sales taxes from customers on transfers of tangible personal property and on certain services and then remit to the proper governmental authority.

Forever 21 made credit sales of $30,000 which are subject to 6% sales tax. The corporation also made cash sales which totaled $20,670 including the 6% sales tax. (a) prepare the entry to record Forever 21s' credit sales. (b) Prepare the entry to record Forever 21s' cash sales.

Accounts receivable 31,800

Sales 30,000

Sales tax payable 1,800

($30,000 x 6% = $1,800)

Cash 20,670

Sales 19,500

Sales tax payable 1,170

($20,670 / 1.06 = $19,500)

The tax rate is 1.06 because we add 1 plus the tax rate of 6%.

Next - Let's learn about payroll!

Employee Related Liabilities- Amounts owed to employees for salaries or wages are reported as a current liability.

In addition, current liabilities may include:

-

Payroll deductions

-

Compensated absences

-

Bonuses

Payroll deductions:

Taxes -

-

Social Security Taxes

-

Unemployment Taxes

-

Income Tax withholding

Compensated Absences: paid absences for vacation, illness, and holidays.

Accrue a liability IF all the following exist:

- The employer's obligation is attributable to emplyees' services already rendered.

- The obligation relates to the rights that vest or accumulate.*

- Payment of the compensation is probable.

- The amount can be reasonably estimated.

*vest- point in time when you met your point of service. example: paid absence-vacation.

*accumulate- vacation time built up.

Bonus Agreements: results in payments to certain or all employees in addition to their regular salaries or wages.

-

Bonuses paid are an operating expense. (same as normal salaries and wages)

-

Unpaid bonuses should be reported as a current liability.

Next - let's look at an Illustration!

Assume a weekly payroll of $10,000 entirely subject to F.I.C.A. and Medicare (7.65%), federal (0.8%) and state (4%) unemployment taxes, with income tax withholding of $1,320 and union dues of $88 deducted. The Fashion company records the salaries and wages paid and the employee payroll deductions as follows:

Journal entry to record salaries and wages paid:

Salaries and wages expense 10,000

Witholding taxes payable 1,320

F.I.C.A Taxes payable 765

Union dues payable 88

Cash 7,827

Journal entry to record employee payroll taxes:

Payroll tax expense 1,245

F.I.C.A. taxes payable 765

Federal unemployment tax payable 80

State unemployment tax payable 400

Let's try one more exercise related to Payroll tax entries!

The payroll of American Eagle for September 2010 is as follows.

Total payroll was $480,000, of which $140,000 is exempt from Social Security tax because it represented amounts paid in excess of $102,000 to certain employees. The amount paid to employees in excess of $7,000 was $410,000. Income taxes in the amount of $80,000 were withheld, as was $9,000 in union dues. The state unemployment tax is 3.5%, but American Eagle is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current F.I.C.A. tax is 7.65% on an employee's wages to $102,000 and 1.45% in excess of $102,000. No employee for American Eagle makes more than $125,000. The federal unemployment tax rate is 0.8% after state credit.

Instructions: Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately.

[Employee side]

Wages and salaries 480,000

Withholding tax payable 80,000

Union dues payable 9,000

F.I.C.A. tax payable 28,040*

Cash 362,960

(we credit cash for the difference to go to the employees)

*Employers match F.I.C.A. - to calculate this total:

$140,000 was exempt and only taxed at the Medicare rate of 1.45%

140,000 x 1.45% = 2,030(480,000 - 140,000) x 7.65% = 26,010

2,030 + 26,010 = 28,040*

[Employer side]

Payroll tax expense 34,480

F.I.C.A. tax payable 28,040

Federal unemployment tax payable 5,600*

state unemployment tax payable 840*

Unemployment tax calculations:

$480,000 - $410,000 = $70,000 subject to unemployment tax

There are two we need to calculate - Federal & State.

Federal: 70,000 x 8% = 5,600

State: 70,000 x 1.2%* = 840

Difference between 3.5% and 2.3% = 1.2%*

Next topic: Contingencies

Contingencies: An existing condition, situation, or set of circumstances involving uncertainty as to possible gain (gain contingency) or loss (loss contingency) to an enterprise that will ultimately be resolved when one or more future events occur or fail to occur.

[In other words, it is something from an uncertain outcome - such as a lawsuit.]

Gain contingencies: generally not recorded.

This is the conservative treatment. Disclose only if the probability of receipt is high.

Typical types of Gain contingencies:

-

Possible receipts of monies from gifts, donations, and bonuses.

-

Possible refunds from the government in tax disputes.

-

Pending court cases with a probable favorable outcome.

-

Tax loss carryforwards.

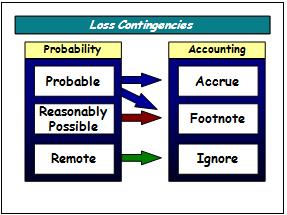

Loss Contingencies: The liklihood that the future event will confirm the incurrence of a liability can range from probable to remote.

Common loss contingencies:

-

Litigation, claims, and assessments.

-

Guarantee and warranty costs.

-

Premiums and coupons.

-

Environmental liabilities.

FASB uses three areas of probability:

-

Probable. - greater than 50%?

-

Reasonably possible.

-

Remote.

'Probable' triggers an entry - If it is probable then you can reasonable estimate it, and therefore you accrue.

If it is resonably possible - then you would footnote it.

If it is remote - you would ignore it.

Now let's try an exercise!

Suppose Charlotte Russe is involved in a lawsuit at December 31, 2011. (a) Prepare the December 31 entry assuming it is probable that Charlotte Russe will be liable for $900,000 as a result of this suit. (b) Prepare the December 31 entry, if any, assuming it is not probable that Charlotte Russe will be liable for any payment as a result of this suit.

(a) Lawsuit loss 900,000

Lawsuit liability 900,000

(b) No entry is necessary. The loss is not accrued because it is not probable that a liability has been incurred at 12/31/11.

Next topic: Warranties

Guarantee and Warranty Costs: Promise made by a seller to a buyer to make good on a deficiency of quantity, quality, or performance of a product.

-

If it is probable that customers will make warranty claims and a company can reasonable estimate the costs involved, the company must record an expense.

There are two basic methods of accounting for warranty costs:

Cash-basis method

Expense warranty costs as incurred, because

1.) it is not probable that a liability has been incurred, or

2.) it cannot reasonably estimate the amount of liability.

Accrual-basis method

-

Charge warranty costs to operating expense in the year of the sale.

-

Method is the generally accepted method.

-

Referred to as the expense warranty approach.

Let's try an exercise!

Farouk Systems Inc., the manufacturer of CHI hair styling products, provides a 2-year warranty with one of its products which was first sold in 2010. In that year, Farouk spent $70,000 servicing warranty claims. At year-end, Farouk estimates that an additional $400,000 will be spent in the future to service warranty claims related to 2010 sales. Prepare Farouk's journal entry to record $70,000 expenditure, and the December 31 adjusting entry.

2010 Warranty expense 70,000

Cash 70,000

12/31/10 Warranty expense 400,000

Warranty Liability 400,000

Let's try one more exercise on Warranties!

Tanning Resources Co. sold 150 Royal sun express tanning beds in 2010 for $4,000 apiece, together with a one-year warranty. Maintenance on each tanning bed during the warranty period averages $300.

Instructions:

(a) Prepare entries to record the sale of the tanning beds and the related warranty costs, assuming that the accrual method is used. Actual warranty costs incurred in 2010 were $17,000.

(b) On the basis of the data above, prepare the appropriate entries, assuming that the cash-basis method is used.

Costs that happened during 2010 -

(a) Cash 140,000

Sales Revenue 140,000

Warranty expense 17,000

Cash Inventory/accrual payroll 17,000

Now calculate the warranty expense: (adjusting journal entry)

150 x 300 = 45,000

45,000 - 17,000 = 28,000

Warranty expense 28,000

Liability for warranty 28,000

(b) No adjusting entry would be made using cash basis accounting.

Warranties aren't so bad! Next - Let's learn about Premiums and Coupons!

Premiums and Coupons: Companies should charge the costs of premiums and coupons to expense in the period of the sale that benefits from the plan.

-

So we must accrue, estimate how many will be redeemed, and expense them.

Company charges costs of premium offers to Premium expense, and credits estimated liability for Premiums.